In my previous post, I looked at Foris GFS Australia Pty Ltd v Manivel [2022] VSC 482 (26 August 2022), in which cryptocurrency trading platform Crypto.com accidentally transferred Aus$10.5m [€7.35m; US$7m; St£6.3m] to an Australian customer when processing an Aus$100 [€70; US$67; St£60] refund, by mistakenly entering her account number into the “payment amount” field. Elliott J held that part of the proceeds could be traced into a property gifted by the customer to her sister, who held the property on trust for the payor.

In my previous post, I looked at Foris GFS Australia Pty Ltd v Manivel [2022] VSC 482 (26 August 2022), in which cryptocurrency trading platform Crypto.com accidentally transferred Aus$10.5m [€7.35m; US$7m; St£6.3m] to an Australian customer when processing an Aus$100 [€70; US$67; St£60] refund, by mistakenly entering her account number into the “payment amount” field. Elliott J held that part of the proceeds could be traced into a property gifted by the customer to her sister, who held the property on trust for the payor.

In this post, I want to look at two other computer-enhanced mistakes. The first is almost unbelievable:

Dad becomes 25th richest man in world after €45 billion lands in account after bank error

A family were made multi billionaires when a banking mishap saw [US$50 billion] €45 billion deposited into one lucky dad’s account, momentarily making him the 25th richest man in the world. … [He] was alerted to the huge sum by his staggered wife, …

The dad-of-two, from Louisiana in the US, … admitted to what had happened and arranged for the money to go back to its rightful owner. … When he alerted [his bank] Chase, they immediately began work to get the funds back, but never said where the money came from, or how the error came about. The money was gone within a few days. …

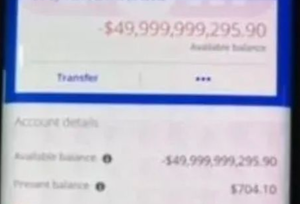

The picture, above left, is an element of a screenshot showing the return of the money. That was probably for the best. He had to return it as a matter of law (see, eg, here, here, here, here, here, and here); if he had tried to keep it, he would have faced criminal charges of theft (see, eg, here, here, here, here, here, here, and here). This happened in June 2021, but I managed to miss reports at the time. I don’t know why it was picked up again recently, but I’m glad it was, because it’s just too good a mistaken payment story to have missed. Indeed, I have to say that I’m stupified, first as to how a bank manages to make a $50billion mistake, and second as to how it didn’t lead the news the world over last June when it happened.

The second computer-enhanced mistake is almost as unbelievable. In an earlier post, I looked at In re Citibank 520 FSupp 3d 390 (SDNY, 2021). Revlon was a customer of Citibank, and had borrowed from other lenders. At a time when it was struggling against insolvency, so much that it had just contrived to avoid an acceleration of a major loan, Revlon nevertheless authorized Citibank to make interest payments to the lenders totaling US$7.8 million. Instead, Citibank mistakenly paid the loans in full, in the amount of c.$894 million. When they discovered their mistake, Citibank sought to get the money back from the lenders; some complied and repaid c.$393 million. But 10 lenders refused to return the remaining c.$500m. Furman J held that Citibank were prima facie entitled to restitution of the mistaken payments from the 10 lenders, but that the the lenders were able to rely on the defence of “discharge for value” (following Banque Worms v BankAmerica International 570 NE2d 189 (NY, 1991); 928 F2d 538 (2d Cir, 1991)). Citibank appealed. Meanwhile, Revlon filed for Chapter 11 bankruptcy protection in June 2022; and Citibank sought to stand in the shoes of the 10 lenders who had been paid off and to exercise those claims against Revlon. However, these interesting subrogation claims are no longer necessary, since Citibank’s appeal against the judgment of Furman J was successful. In Citibank NA v Brigade Capital Managementt LP 49 F4th 42 (2d Cir, 2022) (Findlaw | Justia | 8 September 2022 (pdf) (page references below are to this transcript)) the Court of Appeals for the Second Circuit agreed with Furman J that Citi were prima facie entitled to restitution, but reversed him on the issue of the defence of “discharge for value”, holding instead that the case did not fall within the scope of Banque Worms. Leval J (Sack J concurring) delivered the judgment of the Court; Park J concurred in a separate opinion.

The second computer-enhanced mistake is almost as unbelievable. In an earlier post, I looked at In re Citibank 520 FSupp 3d 390 (SDNY, 2021). Revlon was a customer of Citibank, and had borrowed from other lenders. At a time when it was struggling against insolvency, so much that it had just contrived to avoid an acceleration of a major loan, Revlon nevertheless authorized Citibank to make interest payments to the lenders totaling US$7.8 million. Instead, Citibank mistakenly paid the loans in full, in the amount of c.$894 million. When they discovered their mistake, Citibank sought to get the money back from the lenders; some complied and repaid c.$393 million. But 10 lenders refused to return the remaining c.$500m. Furman J held that Citibank were prima facie entitled to restitution of the mistaken payments from the 10 lenders, but that the the lenders were able to rely on the defence of “discharge for value” (following Banque Worms v BankAmerica International 570 NE2d 189 (NY, 1991); 928 F2d 538 (2d Cir, 1991)). Citibank appealed. Meanwhile, Revlon filed for Chapter 11 bankruptcy protection in June 2022; and Citibank sought to stand in the shoes of the 10 lenders who had been paid off and to exercise those claims against Revlon. However, these interesting subrogation claims are no longer necessary, since Citibank’s appeal against the judgment of Furman J was successful. In Citibank NA v Brigade Capital Managementt LP 49 F4th 42 (2d Cir, 2022) (Findlaw | Justia | 8 September 2022 (pdf) (page references below are to this transcript)) the Court of Appeals for the Second Circuit agreed with Furman J that Citi were prima facie entitled to restitution, but reversed him on the issue of the defence of “discharge for value”, holding instead that the case did not fall within the scope of Banque Worms. Leval J (Sack J concurring) delivered the judgment of the Court; Park J concurred in a separate opinion.

Leval J held that the traditional rule of New York law governing mistaken payments generally calls for restitution of the mistaken payment (p34); and Park J echoed this (p1):

When people receive money by mistake, the law usually requires them to give it back. This commonsense rule allows transferors to reclaim property that rightfully belongs to them — whether misdirected funds, an accidental overpayment, or a credit to the wrong bank account.

Again: “mistaken payments generally must be returned to the payor … Moses v Macferlan (1760) 97 Eng Rep 676, 680-81; 2 Burr 1005, 1012; [[1760] EngR 713 (19 May 1760) (pdf)] …” (p7) [see also Rochfort v Earl of Belvidere (1770) Wall L 45 (pdf)]; “Citibank thus has an unquestionable claim to entitlement under the law of unjust enrichment” (p8).

Leval J continued that the decision of the New York Court of Appeals in Banque Worms endorsed an exception to that traditional rule based on the principle of discharge-for-value (p35):

When a beneficiary receives money to which it is entitled and has no knowledge that the money was erroneously wired, the beneficiary should not have to wonder whether it may retain the funds; rather, such a beneficiary should be able to consider the transfer of funds as a final and complete transaction, not subject to revocation. (18 570 NE2d at 196 (emphases added by Leval J at pp38 and 83).

Again, Park J echoed this (p1):

An exception to the general rule can sometimes protect a recipient who was owed the mistakenly paid money … a creditor who receives a payment in discharge of a debt he is owed can defeat restitution by invoking his own competing claim to the disputed funds.

Leval J concluded (p40) that Citibank is entitled to prevail under the rule in Banque Worms because (i) the defendants were not entitled to the money at the time of the plaintiff’s mistaken payment, and (ii) under NY law, the defendants had constructive notice of Citibank’s mistake.

As to entitlement, under the defence of “discharge for value”, there must at the time of the payment be something to discharge; but if the payment is not then due, then it does not discharge anything. Leval J therefore held that the rule in Banque Worms operated only in favor of a recipient of a mistaken payment who was “entitled” to the money; that is, the defence only applies in circumstances in which the money was actually “due” to the recipient (pp82-83). A “present entitlement requirement … better supports the reasons for the rule” (p89). Hence, he held that the defendants were not entitled to receive repayment for the loans because repayment was not due for another three years (p83). This made it different from Worms:

Worms was entitled to the money. The Defendants in our case were not. Worms’ loan … was payable, and Worms had demanded payment. The Loan in our case was not payable for three more years.

Park J agreed (p1); “you don’t get to keep money sent to you by mistake unless you’re entitled to it anyway” (p2). He described the “discharge for value” rule as a specific application of the principle of bona fide purchase (pp9-10 (cp Leval J at p38); which is effectively how it is treated elsewhere in the common law world; see, eg, Skatteforvaltningen v Solo Capital Partners LLP [2020] EWHC 1624 (Comm) (26 June 2020) [138] (Baker J)), which “protects the secured expectations of creditors who have, without notice of a mistake, given value for the funds in their possession” (p13). And this requires a preexisting entitlement on the part of the recipient to the mistakenly transferred funds (p14). But here, the debt was not due, and the ordinary rule of restitution applies (pp17-20).

The legal position on this side of the Atlantic is the same. As Goff J put it in Barclays Bank Ltd v WJ Simms, Son & Cooke (Southern) Ltd [1980] 1 QB 677, 695, a claim for restitution on the grounds of mistake will fail, inter alia, if “the payment is made for good consideration, in particular if the money is paid to discharge and does discharge a debt owed to the payee … by the payer or by a third party by whom he is authorised to discharge the debt” (emphasis added). As Lord Hope explained in Kleinwort Benson Ltd v Lincoln City Council [1999] 2 AC 349, 408, [1998] UKHL 38 (29 October 1998), a “payee cannot be said to have been unjustly enriched if he was entitled to receive the sum paid to him”. As Lord Sumption remarked in Fairfield Sentry Ltd v Migani [2014] UKPC 9 (16 April 2014) [18] “to the extent that a payment made under a mistake discharges a contractual debt … [owed to] the payee, it cannot be recovered”. Hence, as he and Lord Briggs put it in DD Growth Premium 2X Fund v RMF Market Neutral Strategies (Master) Ltd [2017] UKPC 36 (23 November 2017) [62] “a payment cannot amount to enrichment if it was made for full consideration; and that it cannot be unjust to receive or retain it if it was made in satisfaction of a legal right”.

So, in the classic case of Aiken v Short (1856) 1 H & N 210, 156 ER 1180, [1856] EngR 621 (7 June 1856) (pdf), the plaintiff mistakenly paid money to the defendant to discharge a debt which was owed to the defendant by a third party Carter; the payment discharged the debt; as Pollock CB put it, the defendant had “a perfect right” to receive the money from Carter, and the plaintiffs paid for him. Again, in Dextra Bank & Trust Company Ltd v Bank of Jamaica [2001] UKPC 50 (26 November 2001) Beckford fraudulently presented Dextra’s cheque to the bank. The bank paid out on it; and, when Beckford’s fraud emerged, Dextra sued the bank to recover the value of the cheque. Lords Bingham and Goff held that the bank were bona fide purchasers of Dextra’s cheque, and Dextra’s claim failed. And in Lloyds Bank plc v Independent Insurance Co Ltd [2000] QB 110, [1998] EWCA Civ 1853 (26 November 1998), Lloyds, on behalf of WF Insurance Services, made a payment to Independent which discharged WF’s debt to Independent. Although Lloyds’ payment was mistaken, Independent could rely on Simms (see also Standard Bank London Ltd v Canara Bank [2002] EWHC 1032 (Comm) (22 May 2002) [99] (Moore-Bick J); ICICI Bank UK plc v Assam Oil Co Ltd [2019] EWHC 750 (Comm) (27 March 2019) [38](ii) (Andrew Burrows QC)).

Aiken, Dextra and Lloyds are on the Banque Worms side of the line. On the other hand, where, as in Citibank, the mistaken payment did not discharge a debt owned by the third party to the defendant, the defence is not made out. So, in Jones v Churcher [2009] 2 Lloyds Rep 94, [2009] EWHC 722 (QB) (18 March 2009) Mr Jones sent £42,300 to Miss Churcher’s account at Abbey National Bank. Jones was a car dealer; and Churcher had, in the past, received payments from him for cars supplied Mr Sharkey. However, the £42,300 was to be paid to Lophius’s account with Bank of Scotland in respect of 3 cars to be supplied by Murway, and the payment to Churcher was a mistake caused by a clerical error on the part of Jones’s secretary. Churcher paid the money over to Sharkey, but the cars were never delivered. Jones sought restitution from Churcher, who argued that she had given good consideration for the payment. Although there were some connections between Sharkey and Murway, HHJ Havelock-Allan QC found that Sharkey did not have Murway’s authority to receive payment from Jones, and so Churcher’s payment to Sharkey did not discharge Murway’s debt to Jones. Since no debt had been discharged, no consideration had been given, and Churcher’s defence failed.

As to notice, in Citibank, Leval J held that under NY law, the recipient of a mistaken payment does not get the benefit of the discharge-for-value defence if it has constructive notice that the payment resulted from a mistake, and that the reference to “knowledge” in Banque Worms means constructive notice (p41), and he concluded that the defendants were on inquiry that the unexpected and surprising apparent repayment of the full principal amount of their loans was attributable to mistake (p53). There were four red flags that should have put the defendants on inquiry: (i) there was no prior notice of a prepayment of the loan, to which the defendants were contractually entitled (p54); (ii) it should have been apparent that the nearly insolvent Revlon would have been unable to make a near $1 billion repayment (p55); (iii) since one of the key loans was trading at 20-30 cents on the dollar, it could have been retired far more cheaply than by paying its full value (p57); and (iv) Revlon had contrived only four days earlier to avoid an acceleration of the that loan, and that made no sense if it was planning to repay that debt a few days later (p58). Leval J therefore concluded that “a reasonably prudent investor who faced an avoidable risk of loss if the payment proved mistaken and therefore subject to recall, would have seen fit to make a telephone call to inquire of Citibank” (p76), and that, had the defendants made such a reasonable inquiry (p80), it would have revealed the plaintiff’s mistake (p82). Park J agreed: there were sufficient red flags to put the defendants on notice of Citibank’s mistake (p2).

Again, the legal position on this side of the Atlantic is the same. In Nelson v Larholt [1948] 1 KB 339, 343 a defendant paid a third party on foot of a cheque drawn on the plaintiff; and Denning J held that the defendant, despite having given value (and thereby purchased), had not made reasonable enquires and thus had notice of the plaintiff’s claim. In particular, Denning J held that the defendant “must, I think, be taken to have known what a reasonable man would have known. If, therefore … the circumstances were such as to put a reasonable man on inquiry, and he made none … then he is taken to have notice of it”.

The judgments of Leval and Park JJ in Citibank are very good illustrations of the limits of the defence of bona fide purchase for value without notice. Not only did it not avail the recipients of Citibank’s €500m overpayments, it would plainly not have availed the recipient of Chase’s €50 billion overpayment either. The moral of the story is that, whilst a bank error might be in your favour on the Monopoly board, in the real world it is not a gift from God, and – subject to defences – you have to give it back, however tempting the numbers might be.

Updates (06 February 2024; 30 May 2024; 29 July 2024): (i) Peter G Watts “Re Citibank (the Revlon case) — Pleading a Third Party’s Indebtedness as a Defence to Recovery of a Mistaken Payment” [2023] Journal of Business Law 87 (SSRN) analyses the fact pattern of the case on the basis of Commonwealth case law, and concludes

… that Citibank would have won without needing to show that the recipients ought to have realised that someone had made a mistake. Whereas the NY courts assumed that the recipients were prima facie entitled to assume that the payments were made on Revlon’s behalf to discharge the outstanding loans, a Commonwealth court would simply have concluded that Revlon never authorised the payments and there was no basis for suggesting that Revlon had held out Citibank as authorised to discharge the loans. There is no representation of entitlement in a mere bank payment. Nor could Revlon have ratified the payments.

(ii) Jeffrey H Kahn “A Taxing Mistake” (2022) Cardozo Law Review de•novo 93:

… The primary and original contribution of the piece, however, is to discuss the tax aspects of all the possible outcomes. While some tax consequences are straightforward, there are several interesting and less certain tax results that could apply to all three parties (Citibank, Revlon, and the lenders). This Article will explain those possibilities and review the tax doctrines that will apply once Citibank’s litigation has concluded.

(iii) Layne S Keele “A Billion-Dollar Mistake: Restitution and the Discharge-for-Value Rule” 23(1) Nevada Law Journal 171 (2022) (discussing the District Court judgment); Layne S Keele “To Err is Human, to Restore is (Usually) the Law: Present Entitlement in Restitution’s Discharge-For-Value Rule” 77(1) Arkansas Law Review 1 (2024) (discussing the Circuit Court judgment) (from the abstract):

This Article argues that the Second Circuit’s present-entitlement holding … lacks a historical basis, cannot be justified on the grounds proffered by the concurrence, contravenes existing case law, and risks undercutting the rationale for the rule. Consequently, I will argue that the court’s “present entitlement” requirement should be rejected.

(iv) Dhammika Dharmapala & Nuno Garoupa “The Law of Restitution for Mistaken Payments: An Economic Analysis” 53(1) Journal of Legal Studies 159 (2024) (JLS | SSRN); some extracts:

The aim of this article is to develop a general conceptual framework for the economic

analysis of mistaken payments (and thereby of the law of restitution more generally). … there is only a very limited body of economic literature on the law of restitution, … [and, what little there is] highlights the primary efficiency cost of mistakes as being a choice of precaution by payers that is excessive from society’s perspective. Our framework emphasizes instead that – even when precaution is exogenously fixed – there is a social cost from mistaken payments in the form of transactions that buyer-seller pairs do not undertake because their joint surplus is lowered by the expected value of the mistaken payment to an unrelated third party (absent restitution).… In general, it is clear that [full restitution] … is socially optimal whenever harm is unilateral – i.e., when a mistaken payment imposes costs only on the payer (absent restitution). This is true regardless of whether precaution is fixed, unilateral or bilateral. … When harm is bilateral (i.e., the recipient would suffer some net harm from receiving the payment and making full restitution), our results imply that a regime of [partial restitution] … is socially optimal … Again, this is independent of whether precaution is fixed, unilateral, or bilateral, … While [partial restitution] … is generally optimal in these conditions, it should be noted that our results apply to [partial restitution] … regimes with fixed fractional recovery (i.e., a fixed share of the payment that can be recovered, where the share is unaffected by the parties’ behavior). Regimes that make the fraction recoverable conditional on the recipient’s behavior (as in at least some formulations of the change of position defense) potentially create an additional distortion to the recipient’s consumption or expenditure patterns. … If [partial restitution] … is thought to be too administratively complex, the remaining choice is between [full restitution] … and [no restitution]. In the unilateral harm case, this is straightforward as [full restitution] … is always socially optimal. In the bilateral harm case, however, our framework does not yield an unambiguous answer. The relative merits of [full restitution and no restitution] … depend on the precaution technology (i.e., which party’s precaution is more effective and which party faces lower costs of precaution). …

… the discharge for value defense might best be understood as carving out from the domain of the law of restitution a scenario in which the mistaken payer and the recipient face low transaction costs. … Within our perspective … the economic role of the law of restitution is not to establish contract law defaults for contracting parties, but rather to establish rules for interactions among strangers who face high transaction costs. Moreover, the optimal rules for strangers may potentially differ from those that parties facing low transaction costs may choose contractually. … It is also worth emphasizing that the unappealing outcomes in situations such as Citibank are, to a significant degree, attributable to the insolvency of the debtor, rather than to the discharge for value defense as such.

… Our model both unifies existing insights and provides a new perspective based on the idea that mistaken payments impose a “transaction tax” on contracting parties and thereby lead to foregone socially valuable transactions. The results imply that full restitution is socially optimal when harm is unilateral and partial restitution when harm is bilateral. Our framework also generates some novel insights, for instance on the symmetry of the excess burden from mistaken payments and the behavioral distortions created by the change of position defense. …

One Reply to “Restitution of mistaken payments, again: Chase quickly recovers $50billion; while Citibank eventually recovers (a mere) $500million, defeating defences of “discharge for value””