… and pretty soon, you’re talking real money (to rework Senator Everett McKinley Dirksen’s apocryphal remark).

… and pretty soon, you’re talking real money (to rework Senator Everett McKinley Dirksen’s apocryphal remark).

The last time I blogged about Citibank, it had made a mistaken overpayment of nearly US$1 billion (their restitution claim was successful on appeal). The same post noted another bank’s mistaken overpayment of US$50 billion (the payee co-operated in the reversal of the transaction). These are staggering numbers. But they pale into insignificance beside a Citibank overpayment in the Irish Times today:

Citigroup erroneously credited client account with $81tn in ‘near miss’

Citigroup credited a client’s account with [US]$81 trillion (€77 trillion) when it meant to send only [US]$280, … The erroneous internal transfer, which occurred last April and has not been previously reported, was missed by both a payments employee and a second official assigned to check the transaction before it was approved to be processed at the start of business the following day.

A third employee detected a problem with the bank’s account balances, catching the payment 90 minutes after it was posted. The payment was reversed several hours later, … No funds left Citi, …

The Guardian put the figure in context:

Citigroup credited client’s account with $81tn before error spotted

US bank meant to send $280 but no funds were transferred despite ‘fat finger’ mistake

… A transaction of [US]$81tn (£64tn) would be so huge that it would be unlikely to go through any bank’s systems. It would have certainly gone down as one of the biggest ever fat finger errors, in which the wrong number is entered in a computer system.

The sum would be more than enough to buy the entire US stock market, including all of the big tech companies, at a healthy premium. The US stock market was valued at [US]$62tn at the end of 2024, according to the Current Market Valuation website.

The amount would be also be enough to buy all of the assets of Elon Musk, the world’s richest man, more than 200 times over. His fortune is valued at [US]$343bn, according to Bloomberg’s billionaires index.

The total stock of global wealth was estimated at about [US]$450tn by UBS last year. The total wealth of the UK was estimated at [US]$16tn in 2022. …

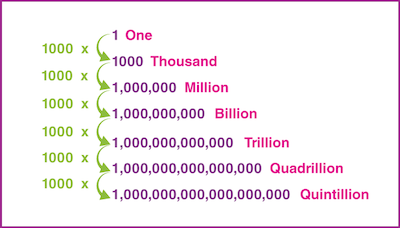

That certainly puts Citibank’s US$81tn into context. Indeed, in the Financial Times (here and here), Stephen Gandel and Joshua Franklin “report the 14-figure near miss was a far larger fat finger folly than any expert the two spoke to had heard of previously”. Hold my beer. In 2013, PayPal mistakenly credited a payee with US$92,233,720,368,547,800 (the overpayment was quickly reversed) – that’s US$92 quadrillion, more than a thousand times Citibank’s US$81 trillion error. So, Citibank have some way to go to match PayPal’s error. Nevertheless, to convert a payment of US$280 into one of US$81 trillion recalls for me another aphorism: to err is human, but to really foul things up requires a computer. (Indeed, it can’t be long before AI makes an erroneous gazillion dollar error that sinks not just a bank or even the banking industry but the entire world economy – my account is available if someone wants to rest that payment in it, just saying).

Anyway, if there is a bank computer error in your favour, however many zeros there are, you must make restitution of the mistaken overpayment (I would, I promise, eventually); failure to do so may even amount to theft (that’s why I would)! One moral of the story is: let’s be careful out there, whether making or receiving bank transfers.