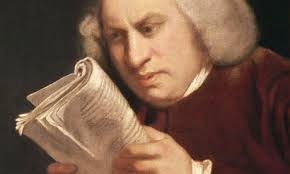

Tax day, excise and Dr Johnson

On this day, 15 April, millions of US citizens will complete their annual tax returns: for the IRS, today is filing day, colloquially known as tax day. It is also the day on which, in 1755, the first edition of Dr Samuel Johnson‘s Dictionary of the English Language was published. Many of the US taxpayers filing their taxes today would probably apply to their situations the sentiments of one of his better know definitions:

On this day, 15 April, millions of US citizens will complete their annual tax returns: for the IRS, today is filing day, colloquially known as tax day. It is also the day on which, in 1755, the first edition of Dr Samuel Johnson‘s Dictionary of the English Language was published. Many of the US taxpayers filing their taxes today would probably apply to their situations the sentiments of one of his better know definitions:

Excise: a hateful tax levied upon commodities and adjudged not by the common judges of property but wretches hired by those to whom excise is paid.

The Commissioners of Excise sought the advice of the Attorney General as to whether the definition was defamatory and invited Johnson to amend it. Characteristically, he declined, and the definition appeared in subsequent editions of the Dictionary. However, the Commissioners did not pursue a defamation claim against him, but there is evidence to suggest that they did keep watching to see if he ever amended the definition.

This post is republished from the updates feed of the website for the conference on Restitution of Overpaid Tax (Merton College Oxford, 9 and 10 July 2010).…

Further to my

Further to my