Subrogation and unjust enrichment – hunting the snark

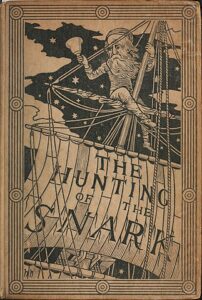

The Hunting of the Snark is a nonsense poem written by Lewis Carroll subtitled An Agony in 8 Fits. In Fit 6, the Barrister dreams that the eponymous Snark serves as counsel for the defence, finds the verdict as the jury, and passes sentence as the judge. Perhaps it is fitting then to observe that, by way of update to yesterday’s post about Bofinger v Kingsway Group Limited (2009) 239 CLR 269, [2009] HCA 44 (13 October 2009), Legal Eagle on SkepticLawyer characterises the judgment as “yet another snark at unjust enrichment”. True, but reaffirming a light approach to the “unifying legal concept” of unjust enrichment is not necessarily a bad thing, even if the tone is indeed unnecessarily snarky. She does concede that, “to give the High Court credit where credit is due, it gives reasoned arguments for rejecting the Banque Financière decision (see Banque Financière de la Cité v Parc (Battersea) Ltd [1999] 1 AC 221; [1998] UKHL 7 (26 February 1998)). It would sound quite reasonable if it weren’t for the usual snark beforehand” (given my views in my earlier post, it’s no surprise that I agree with her here). Her snark is that the Court does not provide similarly reasoned arguments for what she sees as negative knee-jerk responses to unjust enrichment reasoning.…

The Hunting of the Snark is a nonsense poem written by Lewis Carroll subtitled An Agony in 8 Fits. In Fit 6, the Barrister dreams that the eponymous Snark serves as counsel for the defence, finds the verdict as the jury, and passes sentence as the judge. Perhaps it is fitting then to observe that, by way of update to yesterday’s post about Bofinger v Kingsway Group Limited (2009) 239 CLR 269, [2009] HCA 44 (13 October 2009), Legal Eagle on SkepticLawyer characterises the judgment as “yet another snark at unjust enrichment”. True, but reaffirming a light approach to the “unifying legal concept” of unjust enrichment is not necessarily a bad thing, even if the tone is indeed unnecessarily snarky. She does concede that, “to give the High Court credit where credit is due, it gives reasoned arguments for rejecting the Banque Financière decision (see Banque Financière de la Cité v Parc (Battersea) Ltd [1999] 1 AC 221; [1998] UKHL 7 (26 February 1998)). It would sound quite reasonable if it weren’t for the usual snark beforehand” (given my views in my earlier post, it’s no surprise that I agree with her here). Her snark is that the Court does not provide similarly reasoned arguments for what she sees as negative knee-jerk responses to unjust enrichment reasoning.…